Television finds itself in the midst of continued disruption. There are shifts that are not only changing the consumption of entertainment but also creating new distribution channels. Here’s what’s happening in television today.

What is OTT?

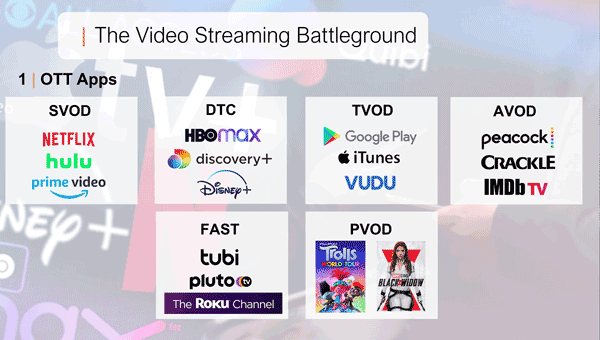

Over-the-top (OTT) services refer to any type of video or streaming media that provides consumers access to movies or television shows by sending the media directly through the internet.

- SVOD (Subscription Video-on-Demand) – viewer sets up a monthly or yearly streaming subscription agreement for a flat montly fee

- TVOD (Transactional Video-on-Demand) – earns revenue via singular transactions aka “pay per view”

- AVOD (Advertising Video-on-Demand) – earns revenue from advertisements placed in streaming services

- DTC (Direct-to-Consumer) – streaming service or channel that sells their services directly to the consumer bypassing retailers and wholesalers

- FAST (Free Ad-supported Television) – live streaming services without the subscription and typically are an extension of traditional linear television channels

Streaming services continue to grow.

With many elements of the television industry changing, one essential thing remains the same: people haven’t stopped wanting to be entertained. Video continues to comprise over two-thirds of the total revenue for subscription streaming services (music accounts for just under a third) and is predicted to keep increasing at a strong pace.

- There are more than 300 OTT providers in the USA alone. (LemonLight)

- OTT TV and video subscriptions are expected to grow to 2 billion by 2025. (Juniper Research)

- Global SVOD subscriptions will increase by 491 million between 2021 and 2026 to reach 1.64 billion.

- China and the US will together account for 49% of the global total by 2026, down from 56% in 2021. (Research and Markets)

- The number of ad-supported video-on-demand (AVOD) viewers in the U.S. were estimated to rise by 17.6% year over year to nearly 128 million in 2021 (Insider Intelligence)

- By the end of 2021, free platforms (“FAST”) are expected to have 89.2 million monthly viewers in the U.S. (Insider Intelligence)

Consumer behavior

- 98% of US consumers subscribe to at least one OTT streaming app. (Brightback Report 2021)

- 84% of respondents now pay for a SVOD service video-on-demand service (SVOD). (Deloitte)

- The average household has four subscriptions (Deloitte)

- Three-quarters of U.S. consumers don’t want to pay more than $30 a month for streaming services. (The Trade Desk survey, Fox Business)

- 59% of consumers said they don’t want to pay more than $20 a month. (The Trade Desk survey, Fox Business)

- 83% of OTT streaming hours in the USA are done using five apps; Netflix, YouTube, Amazon Video, Hulu and Disney+ (Comscore)

- Internet users consume 38 hours of content each month, meaning that they devote almost a full work week to watching videos on mobile apps. (AppAnnie)

- Led by Millennials and Gen Zs, 65% of respondents reported using free ad-supported video services. Some estimates see the ad market for free ad-supported video services doubling in the next two years. (Deloitte)

Top 5 SVOD services

Q4 2021 Earnings Reports

- Netflix: 222 million subscribers

- Amazon Prime Video: 200 million subscribers

- Disney+: 118 million subscribers

- HBO Max: 73.8 million subscribers

- Hulu: 43.8 million subscribers

Top 5 AVOD services

Q4 2021 Earnings Reports (excluding YouTube)

- Facebook Watch: 18%

- Roku Channel: 17%

- Peacock (free with ads): 16%

- Tubi TV: 16%

- Pluto TV: 14%